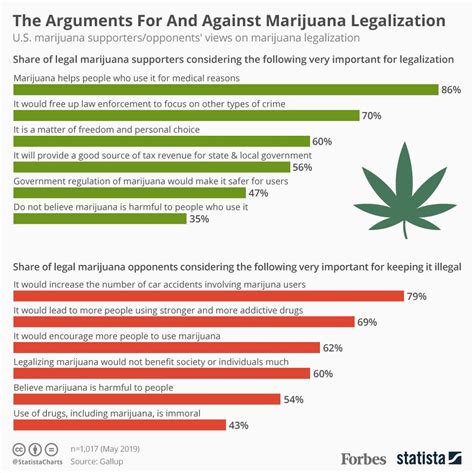

Is Legalized Cannabis Truly Safe? Exploring the Complexities

The debate around the legalization of cannabis continues to grow as more states adopt laws…

Is Medical Cannabis Truly Beneficial? Unraveling the Complexities

The evolving landscape of marijuana usage, both medical and recreational, presents a paradox. Despite its…

Are Our Children at Risk from Secondhand Marijuana Smoke?

The growing legalization and use of marijuana has sparked widespread discussion about its impact on…

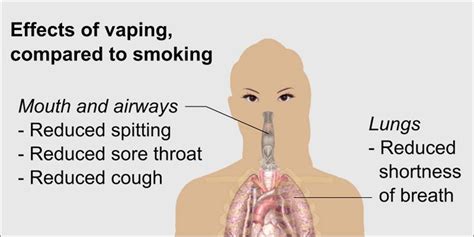

Is Marijuana More Harmful to Lungs Than Tobacco? Exploring the Evidence

The debate surrounding marijuana’s impact on lung health is complex, with various studies offering differing…

Is Cannabis Truly Safe? Understanding the Paradox of Marijuana Use

With the increasing legalization of marijuana across the United States, questions about its safety and…

Is Cannabis Truly Safe? Understanding the Risks and Uncertainties

The widespread legalization of marijuana across various states has sparked significant public and medical interest.…

Is Long-Term Cannabis Use Harmful? Examining the Latest Research and Perspectives

The debate around the long-term effects of cannabis use continues to evolve, with recent research…

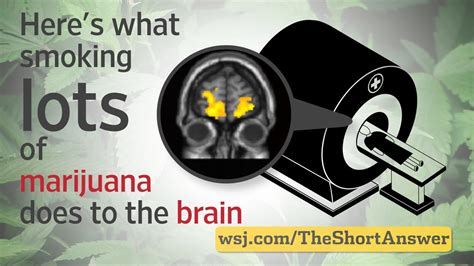

Is Marijuana Harmless? Examining Its Impact on the Brain

While marijuana may be increasingly legal, the question arises: Is it safe for our brains?…

Does Marijuana Affect Male Fertility and Testosterone Levels?

The relationship between marijuana use and male reproductive health has long been a topic of…

Is Long-Term Cannabis Use Harmful or Beneficial? Unraveling the Mystery

The debate surrounding the long-term effects of cannabis use is complex and multifaceted. With increasing…

- 1

- 2

- 3

- …

- 80

- Next Page »